#55: How To Fix Your Downgrade Problem

Every B2B CS Leader I know is struggling with downgrades.

2023 was the year of cost-cutting.

With CFOs tightening their purses, many decision-makers were asked to reduce operating costs to meet the company's margin goals.

In response, every team went through a tech review exercise.

They bucketed their tech stack between must-haves and nice-to-haves.

The result was three-fold:

- Customers cancelled products they didn't need

- Customers right-sized packages they didn't fully utilise

- Customers requested deeper discounts from high-value tools to squeeze further ROI

We all felt the initial pain of the cancellations.

I even wrote an edition of the newsletter on how to win NRR in 2024, focused on downgrades, upgrades and cancellation strategies in this new world.

After the first shock, most have been able to steady the cancellation ship. However, the downgrade trend seems to be here to stay.

This newsletter is here to help you identify, track, tackle and prevent a downgrade issue.

Measuring Downgrades

"You can't improve what you don't measure" - Peter Drucker

Before you fix a problem, you have to understand it. And too many of us only have a high-level view of our downgrades.

Not all downgrades are made the same.

- Is it the tier they use? (ie. Enterprise to Professional)

- Is it the add-ons they purchased?

- Is it a removal of entire products from a suite?

- Is it consumption items? (ie. Seats)

- Is it a reduction in price to stay in the same subscription?

By looking at this data, you might learn that most of your downgrades happen because of one or two root problems that can be addressed at scale. Jackpot! 🎰

Or you might learn that your downgrade problem is less clear-cut, and you'll have to fix a few things to get this number under control.

To do this analysis, I like bucketing 'Downgrades Reasons' into 3 categories:

- Usage: Customers are not utilising key product capabilities.

- Consumption: Customers failed to expand the product adoption.

- Pricing: Customers who are not getting good ROI from your solution.

You can bake these reasons into your CRM, so each time a downgrade happens, the CSM or the customer can mark the reason for the downgrade, making future analysis easier.

In this macro-climate, consumption downgrades are natural. Customers have let people go and right-sizing the subscription makes sense. There's nothing healthy you can do to convince them to retain those licenses or seats.

Your best bet is to convince them to shift dollars into other products that might add extra value.

For Pricing downgrades, you either have to get more specific about demonstrating value (here is how you can start measuring customer outcomes) or better at communicating value (here is a guide to delivering powerful EBRs).

Below I will focus on helping you identify and fix the usage issue.

Tracking "Usage" Downgrade Risk

A big problem with this type of downgrade is that it's hidden.

From the outside, these customers look healthy...

- They are logging in frequently

- They are power users of key tools

- They are engaged

- They are getting value

The problem is that most usage metrics and health scores are pretty dumb.

They are not designed to consider the nuances of the different tiers or add-ons. It's a peanut butter spread approach that tends to tell very little about a customer's likelihood to downgrade.

So from a high-level forecasting perspective, they fall through the cracks for leaders.

There's limited visibility on future risks:

- Adoption gaps aren't flagged as a potential risk for a CSM as well as they could;

- CS leaders don't have visibility of the combined downgrade risk in their install base.

The solution?

Do away with rigid usage metrics that look at log-in frequency and a few top tools utilised, and move to smart and tailored metrics that take into account utilisation based on package and use-case.

These tailored scores will allow you to:

- Monitor the health of your renewal cohorts months ahead of the actual renewal

- Give you and your team the ability to affect change before it's too late

So, once you spot the problem, how do you fix it?

Fixing Usage Related Downgrades

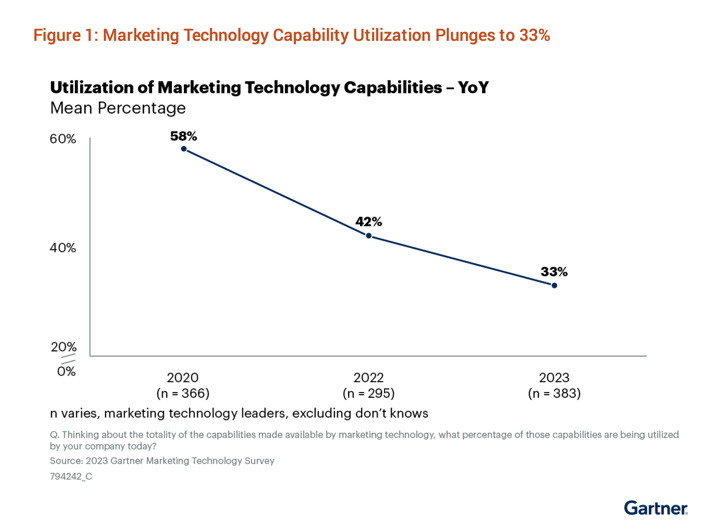

The overall utilisation of SaaS tools is dropping drastically.

In Martech, for example, utilisation has dropped from 58% to 33% in just 2 years. (Gartner)

Our product teams are building more and more functionality, and our customers are adopting less and less of them.

Why is this happening?

Customers are failing to unlock the full value of the tier, add-on or extra products they've purchased.

My hunch is that the problem is two-fold:

1- We are not as intentional when onboarding customers, especially existing ones.

- New Customers: We tend to start with the basic features and workflows for new customers to drive adoption early. But without a plan to expand the usage into core features of their current package, those features go noticed and underutilized.

- Existing customers: When they upgrade or purchase additional products, the options are to either buy a brand new onboarding package(which might be too much) or to self-serve (which might be too little). But just because they used their subscription well in the past, it doesn't mean their usage will magically go up when they upgrade.

2- As we release new features, we are not doing a great job at getting customers to use them to drive value for their business.

To fix both of these problems, you'll need a cohesive value realisation journey:

- Set the goals for the new product, tier or add-on being purchased. You have to answer the question "why are you buying this?" before they sign the dotted line;

- Deliver use-case onboarding, ensuring that your customer is leveraging key functionally to unlock the expected value discussed;

- Tailor the onboarding of existing customers, to include a suitable offer that allows customers to unlock the new value.

- Ensuring a shared Customer Success Plan is in place from day one, so there's a plan beyond onboarding for implementing new strategies, maximising usage and measuring value for the customer;

- Target customers with content and experiences relating to new features, relevant to their use case.

If you sell intentionally, tailor onboarding, continuously enable customers to achieve the solution's full- potential, you WILL increase adoption.

And if the tools are being adopted, and driving value for the customer...

The downgrade risk will drop significantly!

TL'DR

If your customer is downgrading, they likely didn't get value from key extra functionality you offer.

- Implement smart usage metrics that help you understand usage at each tier;

- Ensure your onboarding is tailored to the customer's use case and where they are in their journey with your company;

- Co-create Success Plans with every customer to continuously expand usage;

Do these 3 things and watch your downgrade problem turn into success stories!

-3.png?width=200&height=88&name=This%20is%20growth%20(1)-3.png)

.png)

.png)

.png)